Falling Prices Accentuate Structural Weaknesses in Venezuela

When we think about the “resource curse,” one oft-cited example is oil-rich Venezuela. Despite copious petroleum reserves, people in one of Latin America's top hydrocarbon producers queue for hours outside supermarkets to buy staple foods, and now cite food shortages as a bigger concern than crime.

This is a dramatic consequence of Venezuela's extreme dependence on oil, which accounts for 96 percent of exports and 45 percent of public revenues. The fall in export volumes and the price of oil over the last year has forced a contraction of Venezuela's GDP, limited the amount of US dollars available in the economy, and led to hyperinflation—at a rate north of 60 percent—in 2014. As importers struggle and investors lack capital to maintain their businesses, consumers have felt the pain. The real extent of the damage remains unknown, as the government has not released any official statistics for over six months, including those on GDP and inflation.

To put this in perspective, Venezuela's oil dependence has been acute since the 1990s. Late President Hugo Chavez–as well as Nicolas Maduro, his successor–have only exacerbated problems created by previous regimes' cooptation of the oil sector for political gain. Although few predicted the extent and pace of the crash in oil prices this past year, the Venezuelan government's policies are squarely to blame for the economic woes of its constituents. Now, the administration is looking at extreme solutions for survival.

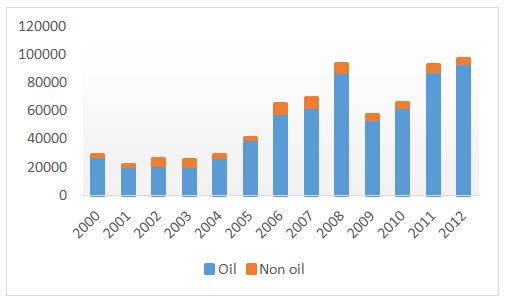

Venezuela's exports (USD millions)

Source: Central Bank of Venezuela (BCV)

During the oil supercycle, Chavez's policies were in line with those of many governments of resource-rich countries in the region. Like Bolivia and Ecuador, the Venezuelan government increased its capture of oil rents. Its reforms granted national oil company PDVSA control of at least 60 percent of every joint venture with private companies. This large amount of cash allowed the government to fund massive social programs called misiones, managed directly by PDVSA in coordination with the central government. The misiones were successful at poverty reduction, which helped build a strong political base amongst the poor for the chavistas.

The focus on social programs has compelled the Maduro administration to contend with chronic underinvestment in infrastructure that has led to decreased production. PDVSA produced 2.8 million barrels per day (bpd) in 2013, 19 percent less than in 2006. It also refined 16 percent less gasoline and exported 19.1 percent less oil than in 2006.

Because of this, the social and political gains from the past regime might now be at risk, with PDVSA's contributions to FONDEN (the natural resource fund created to finance the misiones) falling by 25 percent between 2012 and 2013. Contributions have likely dropped further since that point. Public revenues have also declined. With oil hovering around $40, compared to $100 a year ago, the government could be incurring a budget deficit ranging from 14 percent to 24 percent in 2015, according to the Inter-American Development Bank. This is high – and Venezuela does not have the precautionary savings its neighbors Chile and Bolivia have.

With legislative elections to be held at the end of the year, there is much at stake. Losing the congress would likely destabilize Maduro and pave the way for a future impeachment referendum. An orthodox strategy to get out of the economic crisis would involve devaluating the currency to reduce production costs, become more competitive, and boost exports. This strategy is rather unpopular of course—a currency devaluation would hit the masses hardest, as prices of already scarce common goods would skyrocket overnight.

Accordingly, the Venezuelan government is seeking possible alternative exits from this debacle, both on the domestic and diplomatic fronts.

For Maduro, the ideal way out would have been an OPEC-coordinated increase in prices. Indeed, during an official speech he said that the “fair price” of oil should be around $100. The Venezuelan proposal—supported by non-OPEC producers like Russia and Mexico—was to collectively reduce oil supplies in order to raise prices. The proposal, however, was outvoted as Saudi Arabia and other producers preferred to maintain market share over stimulating higher oil.

Maduro then looked for a second-best option, seeking help from China through a new $10 billion dollar loan. Half of the loan is directed exclusively to the development of mature oil fields, which should allow PDVSA to increase its production in a relatively short period of time. The other half of the loan will fuel a longstanding joint Chinese-Venezuelan development fund. Though the loan might help, it is another significant addition to Venezuela's tab. It was already in debt to China to the tune of $19 billion. In recent years, China has loaned Venezuela $45 billion.

Cash infusions aside, the government cannot sustain its increasing budget deficit, and cutting public spending has become an undeniable necessity. Maduro's cut to public officials' salaries may prove useful in gaining public support for austerity. Cutting military spending also seems like a good choice. The real savings, however, lie in measures that are even more politically difficult, such as cutting gasoline subsidies (where no advances have been made despite earlier announcements).

Looking ahead, exiting the crisis will require less of a dependence on oil and some degree of economic diversification. Maduro did launch a new policy through the “Regionalization for the Social-Productive Development of the Country” bill, adopted last December by congress. The law aims to create special economic zones for industrial development, oil extraction, tourism and other activities.

However, this bill seems to tackle secondary issues, and might not have the intended effect if the final goal is diversification of Venezuela's economy. Especially because diversification has been hamstrung, not by administrative nuisances (like excessive paperwork or a complex bureaucracy), but by an economic policy of discretionary government intervention in productive sectors of the economy. For example, the

nationalization of the cement and steel industries have left the construction industries crippled (even the contractors of the public housing programs) as it became increasingly dependent on the import of goods.

Maduro's announcement of the law references class warfare and blames the economic crisis on multinational companies. If these dynamics were indeed the root of Venezuela's problems, the proposed law wouldn't suffice to fix them. In addition, economic diversification requires public investment, which the government cannot afford to make at this stage.

None of Maduro's responses to lower oil prices are likely to prove a panacea for Venezuela. And as social tensions rise, the Venezuelan government is exercising its complete control over the armed forces and public information in general. The government is increasing repression in lockstep with rising public discontent at the state of the economy.

Will chavistas take stock, open up the political space and prepare for institutional reform? This is what many in Venezuela and Latin America are hoping for, even calling for the pope to intervene. In the meantime, the alliance of opposition parties, la Mesa de Unidad Democrática, also known as Unidad Venezuela, sees the oil problem as an institutional one. Its proposals aim to separate the political role of the president of PDVSA—who often also holds the role of minister of oil and mines at the same time—and open the sector to private investment. But it remains to be seen what its approach is in a falling price environment.

As the plan for special economic zones takes shape and more people seek an OPEC solution, the Venezuelan government seems to be pushing its model to its limits. But chavistas and Unidad Venezuela are not the only voices out there. More recently, a critical view on oil policy was articulated by a conglomerate of student organizations. This is healthy, and should pave the way for even more groups to get involved. Upcoming elections could represent an opportunity to go beyond oil dependency and start talking about these issues from an industrial policy standpoint.

Alonso Hidalgo is NRGI's Latin America program assistant.