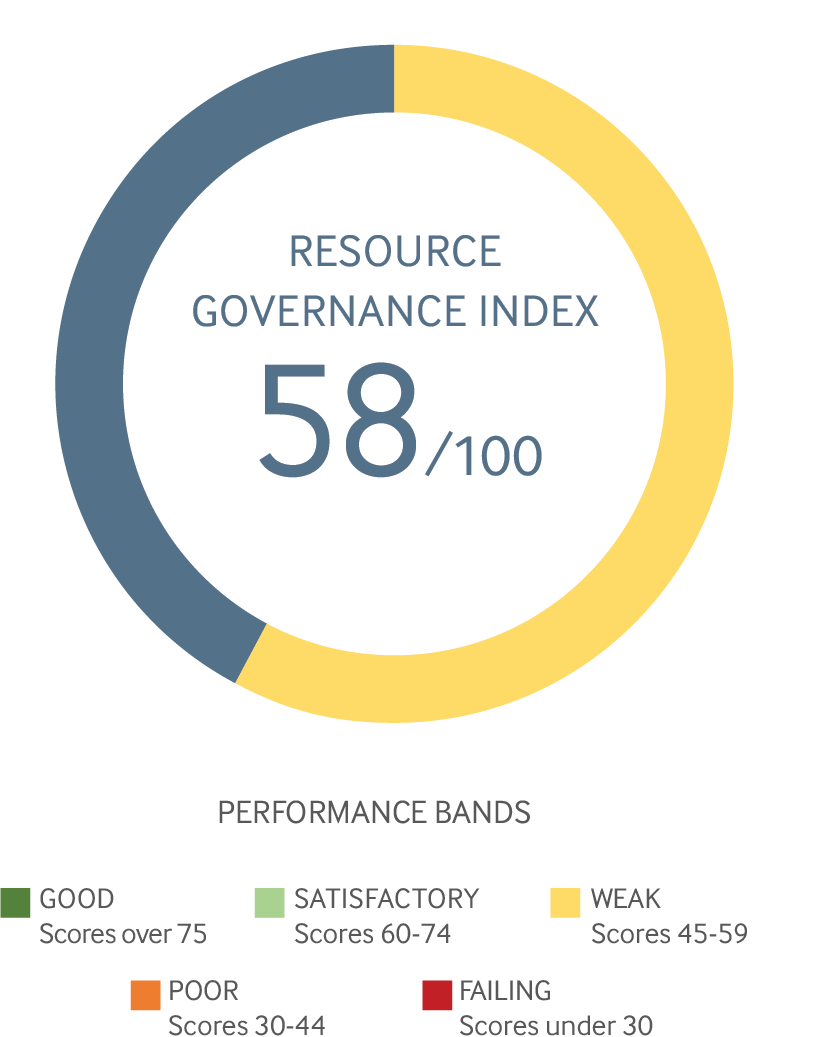

2021 Resource Governance Index: Tanzania (Mining)

Read the press release.

View the launch event »

Tanzania’s mining sector has scored 58 out of 100 points in the 2021 Resource Governance Index (RGI). While the score has increased by 9 points since the 2017 RGI, owing largely to improvements in the governance of revenue management, the overall performance of Tanzania’s resource governance remains “weak”. Value realization placed at the lower end of “satisfactory”, while the broader enabling environment placed firmly within the weak performance band.

- Tanzania’s governance of local impact classified as weak as it did in the 2017 RGI. Strengthening the disclosure of environmental and social impact assessments and mitigation plans and amending land legislation to provide for the resettlement of landowners and compensation to land users could improve this area.

- State-owned enterprise governance is negatively impacted by a lack of production and commodity sale disclosures, resulting in a “poor” score of 41. This is especially concerning given state-owned mining company STAMICO’s active participation in Tanzania’s gold sector.

- Tanzanian’s mining sector has a considerable gap between established legal frameworks and their enforcement in practice. The weak enforcement of rules surrounding local impacts and state-owned enterprise governance are key causes of this growing “implementation gap”, which has widened to -29 points in the 2021 RGI.

- National budgeting governance, which registered as satisfactory, could move into the “good” category with improvements to fiscal rules monitoring by an external auditing authority.

- The Ministry of State for the Environment and Vice President’s Office should create legal provisions for environment and social impact assessment disclosure rules and ensure their enforcement. Such disclosures can help citizens understand whether mining operations are complying with national legislation and regulation, thereby enabling them to hold government and mining companies accountable. This can also help companies build trust with local communities, thus strengthening their social license to operate.

- The government should take steps to effectively ensure resettlement provisions are enshrined in land laws to maintain consistency across both mining and land laws. This will ensure mining operations mitigate the negative impacts on local communities.

- The government can consider setting up a sovereign wealth fund to manage its mining revenues to meet its commitment to raise mining’s contribution to Tanzania’s GDP from the current 6.7 percent to 10 percent by 2025. This could mitigate the risk of the resource curse and cover budget deficits if resource revenues decline.

- The Ministry of Minerals should stand by its June 2020 commitment to disclosure mining contracts. Not only does this enable citizens to understand the agreed terms of extractive projects, but it can also hold all parties accountable for non-compliance, incentivize government officials to arrange fair contracts and deter them from concluding contracts that are disadvantageous to citizens.

- The Ministry of Minerals should soften amendments to Tanzania’s mineral laws, which have afforded the government discretionary room to cancel and suspend contracts. This will improve rule of law and regulatory quality, creating a more conducive environment for investors.

- The Ministry of Minerals must improve governance of state company STAMICO by disclosing annual reports, commodity sales information, and joint venture projects and subsidiary information. This will allow citizens to scrutinize the data to ensure revenues generated are managed in the interest of citizens. It will also raise STAMICO’s financial performance by improving access to capital, and consequently increase government’s share of dividends.

The 2021 RGI assesses how 18 resource-rich countries govern their oil, gas and mineral wealth. The index composite score is made up of three components. Two measure key characteristics of the extractives sector – value realization and revenue management – and a third captures the broader context of governance — the enabling environment. These three overarching dimensions of governance consist of 14 subcomponents, which comprise 51 indicators, which are calculated by aggregating 136 questions. For more information on the index and how it was constructed, review the RGI Method Paper.