2021 Resource Governance Index: Tanzania (Oil and Gas)

Read the press release.

View the launch event »

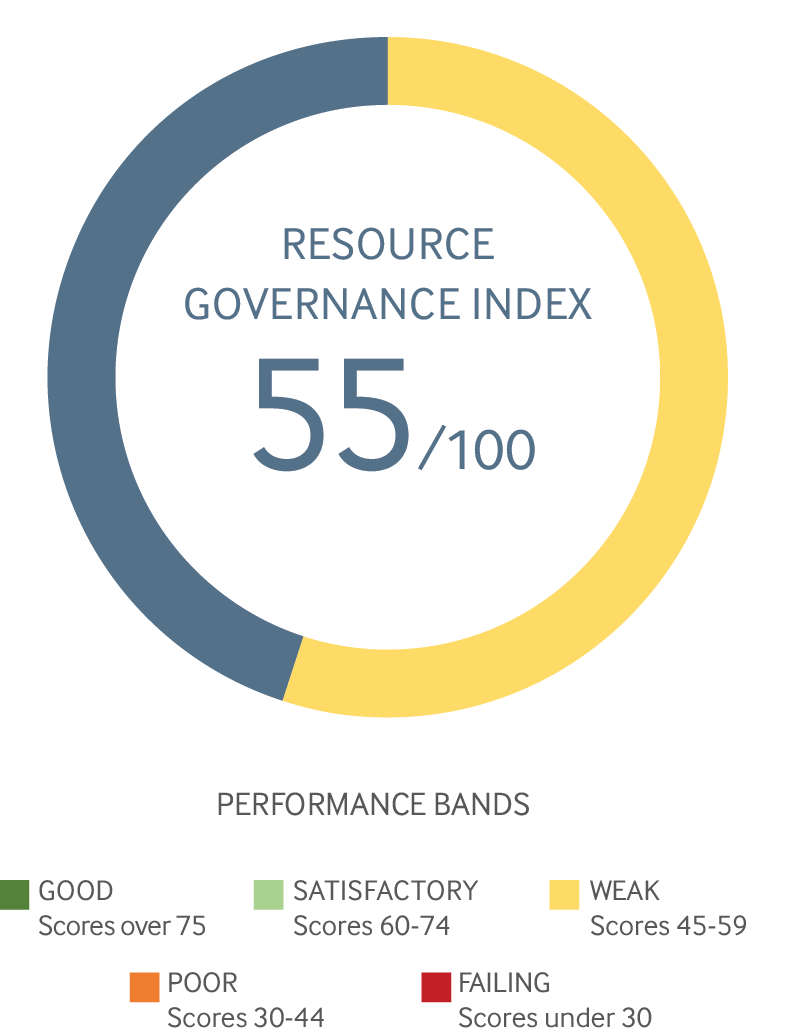

Tanzania’s oil and gas sector has scored 55 out of 100 points in the 2021 Resource Governance Index (RGI), registering a 2-point increase since the 2017 RGI. This improvement is largely owing to the country’s gains in the governance of revenue management. Nevertheless, revenue management remains in the “weak” performance band alongside value realization and the broader enabling environment.

- Tanzania’s governance of oil and gas sector taxation registered as “good”. Despite the stronger performance in taxation, overall value realization remained in the weak band, owing to poor governance of licensing, particularly the absence of a cadaster and contract disclosures.

- The governance of local impacts warrants attention as a lack of rules and disclosures related to environmental and social impact assessments and mitigation plans prevents the Tanzanian public from understanding the environmental and social effects of the country’s gas industry.

- Tanzania’s Oil and Gas Fund, now partially operational, demonstrates a strong legal framework governing investment rules and financial reporting.

- The new administration’s pledge to create a business-friendly environment for gas investors provides the government with the opportunity to leverage LNG reserves to capitalize on opportunities created by the global energy transition, in which many see natural gas playing a key role.

Recommendations

- The Ministry of Energy should establish an oil and gas cadaster. This would improve public administration efficiency, transparency, and also make it easier for all governmental authorities to upload information into the public domain via an online portal, allowing citizens and other stakeholders to engage in dialogue about how the country’s resources are managed. Tanzania’s mining cadaster is a relevant example of how this could be done in the oil and gas sector.

- Tanzania’s parliament should pass laws requiring senior public officials to publicly disclose their financial holdings and ensure that this is enforced. Doing so can prevent conflicts of interest and help ensure compliance with anticorruption provisions.

- The Minister of Energy should enforce oil and gas contract disclosure rules. Doing so enables citizens to understand the agreed terms of projects and hold each party accountable for non-compliance. It also incentivizes government officials to arrange fair contracts and deters them from concluding contracts that are disadvantageous to citizens.

- The Business Registration and Licensing Agency (BRELA) should prioritize enforcement of beneficial ownership rules. This mitigates the risk of the government going into business with disreputable individuals, and can also prevent tax evasion, ensuring that the country receives the revenues it is owed.

- The Ministry of State for the Environment and Vice President’s Office should create a provision for environmental/social impact disclosure rules in legislation and ensure their enforcement, as environmental and social disclosures can help citizens understand whether extractive operators are complying with national legislation and regulation. It can also help companies to build trust with local communities, strengthening their “social license to operate.”

- The Ministry of Energy should stand by the commitment to resume project negotiations with investors, which previously stalled due to contentious regulatory, fiscal and local content regulations. This will be crucial to supporting the country’s ambitions to supply gas to the region and reduce dependence on imported oil.

The 2021 RGI assesses how 18 resource-rich countries govern their oil, gas and mineral wealth. The index composite score is made up of three components. Two measure key characteristics of the extractives sector – value realization and revenue management – and a third captures the broader context of governance — the enabling environment. These three overarching dimensions of governance consist of 14 subcomponents, which comprise 51 indicators, which are calculated by aggregating 136 questions. For more information on the index and how it was constructed, review the RGI Method Paper.