Forecasting Ghana's Oil Revenues for the 2015 Budget Using a Fiscal Model of the Jubilee Field

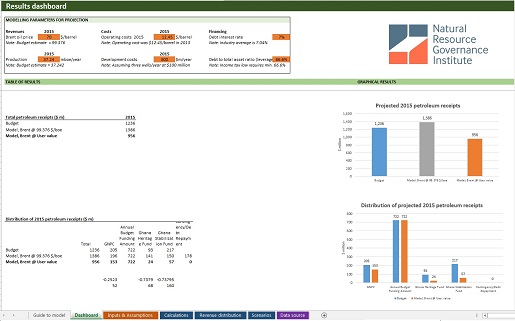

In order to help Ghanaian MPs and the general public understand the potential impact of volatile petroleum prices on the implementation of the 2015 budget, we have built an oil revenue forecasting model. The tool uses only publicly available data and information. It is provided in Microsoft Excel (.xlsx), and released under an open licence so that it can be used by anyone. It can also be edited ,refined, and updated as events in Ghana and the world evolve.

This modeling was only made possible due to the advanced state of oil sector disclosures in Ghana: contracts for the most important producing oil field (the Jubilee oil field) are published, the country is EITI compliant, national laws require transparency and regular reporting, and international oil companies such as Tullow and Kosmos disclose further key information.

With a publicly available model, engaged citizens can calculate the impact of different price scenarios on Ghana’s 2015 budget. We have presented our findings at budget review hearings and to the Public Interest and Accountability Committee, an institution created by revenue management legislation to publicly monitor implementation of the law. And we will continue to engage with stakeholders to support effective planning and oversight of the budget throughout 2015.

The open model not only helps individuals understand the effects of petroleum revenues on the budget, but it also clarifies the dynamics of taxation from the Jubilee oil project, including petroleum contract implementation by the oil companies in the joint venture. If the model exposes a large shortfall in a particular revenue stream, that would flag the need for further investigation of revenues, costs and tax levies.

Despite our best efforts, this model still comes with important limitations compared to those of government authorities, oil companies and international financial institutions like the IMF and the World Bank, which have access to proprietary or privileged information. Although we are confident that our model captures magnitudes and trends with a reasonable degree of accuracy, it may be less precise because it is based solely on public information.

We also hope that the model will provide grounds for collaborative work and learning. We will henceforth continue working with stakeholders in Ghana to refine the model and encourage disclosure of additional open data. No model is perfect, and we welcome feedback from users.

Please be in touch with us at [email protected] (David Mihalyi).