Risky Bet: National Oil Companies in the Energy Transition

Read the press release.

Watch the event recording.

The global energy transition from fossil fuels to cleaner energy will profoundly affect the global economy. It will limit how much greenhouse gases humanity emits and hopefully avoid catastrophic global warming. This transition will, however, also have a profound effect on state-owned national oil companies (NOCs).

NOCs—in which the government is the sole or the dominant shareholder—produce half of the world’s oil and gas, and invest 40 percent of the capital in the global oil and gas industry. They are also important for millions of citizens in the developing countries where many NOCs operate.

This report explores the risks the energy transition brings for NOCs and governments reliant on oil revenues. With the pace of energy transition uncertain, the authors of this report offer a warning to governments and NOCs as they consider their future investment plans.

Key messages:

Watch the event recording.

The global energy transition from fossil fuels to cleaner energy will profoundly affect the global economy. It will limit how much greenhouse gases humanity emits and hopefully avoid catastrophic global warming. This transition will, however, also have a profound effect on state-owned national oil companies (NOCs).

NOCs—in which the government is the sole or the dominant shareholder—produce half of the world’s oil and gas, and invest 40 percent of the capital in the global oil and gas industry. They are also important for millions of citizens in the developing countries where many NOCs operate.

This report explores the risks the energy transition brings for NOCs and governments reliant on oil revenues. With the pace of energy transition uncertain, the authors of this report offer a warning to governments and NOCs as they consider their future investment plans.

Key messages:

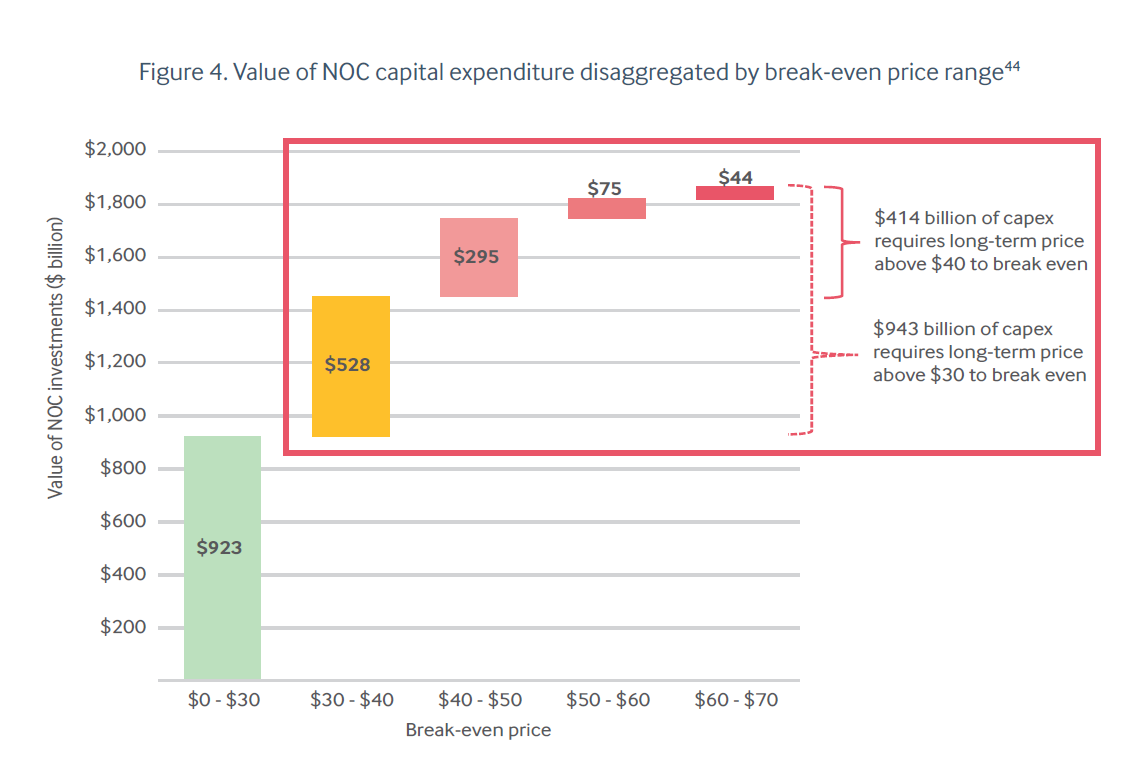

- If national oil companies follow their current course, they will invest more than $400 billion in costly oil and gas projects that will only break even if humanity exceeds its emissions targets and allows the global temperature to rise more than 2°C.

- Either the world does what’s necessary to limit global warming, or national oil companies can profit from these investments. Both are not possible.

- State oil companies’ investments could pay off, or they could pave the way for economic crises across the emerging and developing world, and necessitate future bailouts that cost the public. Some oil-dependent governments in Africa, Latin America and Eurasia are making particularly risky bets with public money.

- Many national oil companies have incentives to continue spending big on new oil and gas projects. As a result, company officials might not, on their own, change course to account for the energy transition away from fossil fuels toward green energy, nor make investment decisions that serve the interests of citizens.

-

Governments—through finance and planning ministries, presidential offices and public accountability bodies—must act to promote a more sustainable economic path. Governments should:

- Understand the extent of national oil companies’ exposure to a decline in oil and gas prices

- Revisit rules on cash flows into and out of state-owned companies

- Require or incentivize lower-risk investment decisions

- Benchmark and measure national oil company performance, improve corporate governance, and report consistently to citizens.

Authors

David Manley

Lead Economic Analyst – Energy Transition

Patrick Heller

Chief Program Officer