Contract Transparency is an Extractive Industries Success Story—But It’s Not Over Yet

This week we’re seeing a renewed push in the decades long fight to end secret deals between governments and companies in the oil, gas and mining sector. The Extractive Industries Transparency Initiative (EITI) has organized Contract Transparency Week—a series of webinars aimed at helping EITI-implementing countries undertake reforms to disclose contracts. And the global Publish What You Pay coalition is launching the #DiscloseTheDeal campaign to demand full and prompt disclosure of oil, gas and mining contracts around the world.

These moves cap two years of solid progress on public contract transparency since 2019, including:

- A new EITI requirement. The EITI international board made it a requirement for the 50+ countries implementing the EITI Standard to disclose all contracts or licenses granted, entered into or amended from 1 January 2021.

- Increased private sector support. Companies like Rio Tinto and Kosmos Energy have taken the lead by publishing contracts on their websites. In addition, there are now at least 20 companies that publicly support contract transparency. These include Glencore and South32, which issued public statements in support of contract transparency for the first time; Shell, which upgraded its policy on the issue; and Total, which publicly encouraged host governments with which it works to disclose contracts.

- Increased country-level disclosure and policy developments. There are now 49 countries that have officially disclosed at least one extractive industry contract and 30 with policies in place making publication mandatory. This includes countries where oversight is critically needed. During the last two years, for example, the governments of Equatorial Guinea, Mauritania and Ukraine officially disclosed contracts for the first time.

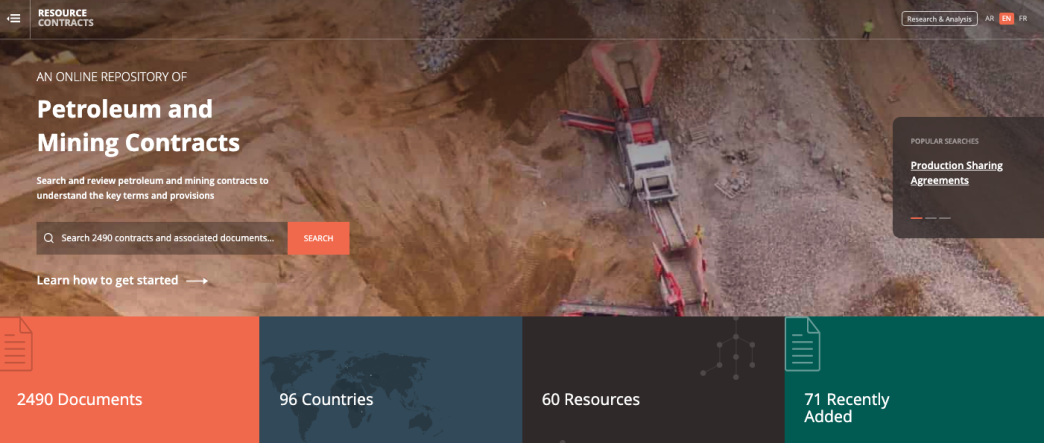

- More public contracts than ever. ResourceContracts.org—the world’s largest open repository of extractive industry contracts—now contains close to 2,500 documents from 96 countries. Over 600 of these have been tagged to highlight key clauses and facilitate research.

With this momentum and so many achievements, is it time to declare “mission accomplished” on contact transparency? Not yet. Here are three reasons that contract transparency still demands our attention:

1. Many important contractual documents remain secret

While many countries have officially disclosed at least one contract, the number of countries that disclose all of their contracts is much lower. By our latest count, only 24 countries (20 of them EITI countries) have disclosed comprehensively in at least one sector (petroleum or mining) and just 7 (6 in EITI) disclosed everything in both sectors.

Citizens, companies and governments must also reflect on which documents are relevant for each project. Most contract transparency advocacy has focused on the main contract document that contains most of the terms associated with exploitation of natural resources, but in many jurisdictions, additional terms feature in a range of associated social and environmental documents. These documents have not been published with the same frequency as main contracts, but they are now receiving attention they deserve. In the EITI standard full disclosure means disclosing the main contract as well as any annexes, addenda or riders, and alterations or amendments.

In some countries, the specific nature of financial flows from the extractive industries may mean that accountability actors need to look beyond upstream contracts. In Ghana and DRC for example, public debates have taken place this year around arrangements under which governments use future streams of natural resource income to leverage financing. While the Agyapa deal in Ghana is still hotly contested and may not come to fruition, the contract associated with Dan Gertler’s purchase of royalties from Congo’s Metalkol was disclosed by the DRC’s national EITI process during the last month following continued civil society advocacy on these issues. This is an important development given that NRGI research shows that publication of resource-backed loan documents remains rare.

Another area of extractive industry dealmaking where contract transparency would also bring benefits relates to sale of oil, gas and minerals by governments (often through complex, loans and swap arrangements agreed with commodity traders). While disclosure of these documents is not yet the norm, the EITI Standard now encourages implementing countries and state-owned enterprises to publish sales agreements. Illustrating of the scale of some of these deals, an upcoming NRGI report shows that in 2019 in Ghana, two large long-term sales agreements accounted for 59 percent of all oil revenues amounting to a whopping 6 percent of all government revenues that year. With so much at stake, public scrutiny is much needed.

2. An implementation gap presents risks of backsliding

The new EITI requirement means that at least 19 countries will have to disclose contracts for the first time next year. A failure to follow through could result in a hefty “implementation gap,” providing an opportunity for detractors to claim that disclosing contracts is too hard. This threatens to undermine hard-won progress on global norms on contract transparency, but also extractive governance more generally. Mobilizing so many governments to act during a global pandemic is going to be a challenge, but making a success of contract transparency will support the success of the wider transparency movement.

3. In these uncertain times, access to contracts is as important as ever

Through a range of provisions—including fiscal terms, stabilization clauses and force majeure rules—extractive industry contracts dictate the distribution of project risks and rewards between the private sector and the state. With the coronavirus pandemic and the energy transition bringing increasing uncertainty to the extractive industries worldwide, access to contracts will be essential to understanding how price changes will impact national assets.

Gold mining in Myanmar

Finally, as governments and companies revisit contract terms in response to changing circumstances, access to contracts (particularly any alternations and amendments) becomes ever more important in understanding how legal frameworks governing oil, gas and mining projects are changing. When governments and companies keep this information secret, it is impossible for citizens, the media, civil society and other oversight groups to determine whether governments are issuing overly generous incentives to companies, or whether parties to negotiations are benefiting narrow interests at the expense of the country’s citizens.

There’s a lot to do. That’s why we at NRGI, alongside partners like EITI and PWYP, will continue our work to secure further progress on contract transparency in 2021.

Robert Pitman is a senior governance officer at the Natural Resource Governance Institute (NRGI).

Myanmar photo by Andre Malerba for NRGI

Authors

Robert Pitman

Senior Governance Officer