Could Natural Resource Revenue Sharing Help Secure Peace in Myanmar?

On 8 November, Myanmar will vote for a new government. Much is at stake.

Many analysts expect Aung San Suu Kyi’s National League for Democracy (NLD) to win the November poll. (The NLD won 43 out of 45 seats in a 2012 by-election.) Should this happen, or should the NLD form a coalition with smaller parties, Myanmar would secure its first majority civilian government in 53 years.

Enormous challenges face whoever wins the election, from addressing severe development deficiencies—the 2014 census indicates Myanmar has one of the shortest life expectancies and lowest levels of access to clean water in Asia—to building peace with about 18 armed ethnic groups.

Several of those groups have stated that natural resource revenue sharing between regions must be included as a topic “for further negotiations” with the government as part of any multilateral ceasefire. Even today, soldiers active in conflict areas say that control over natural resource development is a primary shared goal. As such, resource revenue sharing is likely to play a central role in determining whether today’s democratic transition is translated into peace and development in resource-rich regions.

In recognition of this potentially historic shift away from centralized power, a number of technocrats and advisors to the government, as well as opposition members, have suggested expanding fiscal decentralization, already underway to some degree. They argue that decentralization, including decentralization of resource revenues, would improve service delivery to some of the neediest parts of Myanmar and help redress over five decades of perceived marginalization of ethnic minorities.

In addition to being a key component of any long-term peace and security strategy, resource revenue sharing could help improve the quality of public investment in Myanmar and attract high-quality investors to the extractive sector. Whether or not it succeeds will depend on how any prospective system is designed. NRGI is currently studying the fiscal decentralization process and how resource revenue sharing—both intergovernmental transfers and tax assignments—could be implemented. The research—to be released later this year—is meant to help support Myanmar’s consultations on how to distribute its natural resource revenues.

Myanmar’s resource wealth

Where are the most valuable natural resources actually located in Myanmar? And are the poorest states the most resource-rich?

Today, approximately 99 percent of official oil, gas and mining revenues are collected by the national government or state-owned entities, as prescribed by the 2008 constitution. Transfers of these and general revenues to subnational governments are ad hoc, generally favoring conflict-prone areas like Kachin, Kayah and Tanintharyi.

Oil and gas are much larger contributors to government coffers than minerals. The sale value of hydrocarbons extracted in Myanmar in the 2012-2013 fiscal year was estimated at USD 5 billion, most of which was from gas exports. It is unclear what percentage of the profits from petroleum and mineral extraction are collected in taxes and royalties by the union government. How much is exported and how much is reinvested or held in domestic companies, whether private, state-owned or military-affiliated, is also unclear, though Myanmar’s EITI process may improve access to information soon.

In terms of minerals, foreign sources place the value of production much higher than the officially reported USD 1.15 billion in 2013-2014 exports. UN trade data shows nearly USD 12.3 billion in precious stones were exported from Myanmar to China in 2014 alone. By our estimates, actual precious stones exports were more than 10 times more valuable than what was reported by the government. The box below shows the location of Myanmar’s hydrocarbon and mineral wealth.

A resource-poverty correlation?

According to the 2014 census, conflict-affected and mineral-producing Shan state has by far the lowest literacy rates and the second-worst access to clean water of any area in Myanmar. Oil-producing Magway has some of the highest infant mortality rates and lowest access to sanitation facilities.

However some of the poorest regions, such as agricultural Ayeyawady or Chin, do not have significant on-shore non-renewable resources. Ayeyawady has some of the highest child mortality rates and worst access to clean water in Asia. Only 12 percent of the population in the region have access to electricity at home. Chin has the second highest child mortality rate and third lowest literacy rate in the country. Thus poverty and resource wealth may not go hand-in-hand in Myanmar.

Perhaps less surprisingly, some of the strongest development indicators can be found in Mandalay and Yangon regions, along with the capital Naypyidaw, all of which contain large cities.

Ethnic grievances and resource wealth

The links between violent conflict and resource wealth are also unclear. Kachin, Kayah, Kayin, Mon, Rakhine and Shan are the regions that have suffered most from conflict over the years. Of these, Kachin, Kayah and Shan, which have large ethnic minority populations have significant on-shore hydrocarbon or mineral production. Bamar-majority regions with significant on-shore production of valuable hydrocarbons or minerals, such as Magway, Mandalay and Sagaing, have not experienced as much violence. (Bamars are the dominant ethnic group in Myanmar.)

While Rakhine does not have significant on-shore production, it is close to the off-shore Shwe gas field. Rakhine has suffered from ongoing conflict and persecution of the Rohingya people and remains one of the poorest parts of Myanmar, with by far the worst access to sanitation facilities in the country and ranking low on nearly every social indicator. Important gas pipelines also run through Rakhine, as well as through Bago, Magway, Mandalay, Mon, Shan, Tanintharyi, and Yangon.

It appears that, in Myanmar, resource wealth is linked to violent conflict insomuch as it intersects with ethnic grievances. Historically, and even today, most of the benefits from natural resource extraction in Myanmar have accrued to the Bamar-led Union government and those with government associations, such as military affiliated companies. The dearth of direct benefits accruing to minority groups in resource-rich regions has fueled a sense of injustice there.

As such, resource revenue sharing and fiscal decentralization more generally are critical components of the peace process and would improve local monitoring and enforcement of natural resource contracts. That said, no resource revenue sharing regime can successfully achieve these goals without national consensus on the formula before implementation, a consensus that can be built regardless of who wins the November election.

Andrew Bauer is senior economic analyst with NRGI. Maw Htun Aung is NRGI’s Myanmar officer.

(For a Burmese-language version of this article, please click here.)

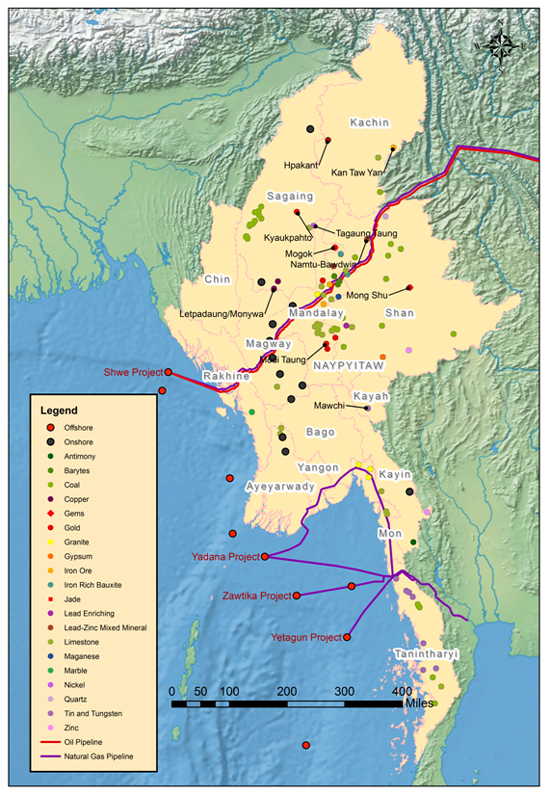

Distribution of Myanmar’s Hydrocarbon and Mineral Wealth

(Burmese-language version of this map»)

While most oil and gas production is currently offshore, pipelines run through many states. The older gas network (serving the Yadana and Yetagun fields) and the newer one (serving the Zawtika field) run through Yangon, Bago, Mon and Tanintharyi. The new Shwe oil and gas pipeline passes through Rakhine, Magway, Mandalay and Shan. As of April 2014, there were also 17 onshore blocks producing oil or gas, many in Magway.

As of 2013, the most recent year reported by the Ministry of Mines, there were large-scale mines operating in all but two states and regions and active, legal mines in all but Chin state. Among the most important of these are the Letpadaung copper mine in Sagaing region, the Hpakant jade mines in Kachin state, ruby and sapphire mines in the Mandalay region and Shan state, and the Kyaukpahto and Modi Taung gold mines in Sagaing and Mandalay regions, respectively. Illegal mines also dot the country.

Exploration activities are also underway in nearly every state or region. Among the most promising deposits are iron ore in Kachin, Bago and Shan states; lead and zinc in Shan; and gold in Mandalay and Sagaing. The government has plans to expand copper, nickel and chromite production at a minimum.