Crony 2014: Drilling Down into The Economist's Strike-It-Rich List

Two-thirds of the wealth in billionaires’ hands originates in developing countries. So claims The Economist’s recent crony-capitalism piece, a study of the billionaires that get rich by capturing rents rather than adding value to the economy. The Economist proposes a simple but illuminating index to measure how prominent a role crony capitalists play in society.

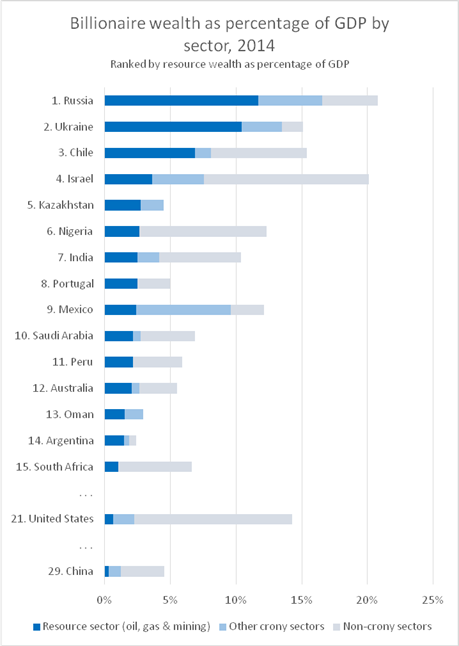

We decided to replicate the exercise (cribbing the methodology), but this time highlighting natural resource cronyism, focusing on the subset of those billionaires who’ve become wealthy from natural resource (oil, gas and mining) rents. We find that more than one-third (34 percent) of “crony wealth” is linked to extractive industries, by The Economist’s yardstick.

While, as the article argues, real estate, infrastructure, telecoms and banking are all potentially prone to corruption and regulatory capture, resource extraction is an area where rent-seeking opportunities are probably the most widespread, especially in developing countries. In fact, the term rent stems from Adam Smith`s division of income (into profit, wage and rent)—and he defined rent as monies stemming from land and natural resources. These rents from nationally-owned natural resources should benefit the state and citizens. If resource extraction provides immense returns to investors, it could likely indicate an inefficient taxation regime and/or weak competition.

The Economist’s methodology identifies specific sectors its editors consider particularly prone to rent-seeking and look how much wealth billionaires active in these industries accumulated, drawing on details of personal wealth from the headline-grabbing Forbes’ world billionaire list. Adding up crony-sector billionaires’ wealth for each country divided by total GDP provides a comparable metric, where the higher the ratio, the more “crony” the capitalism.

(A few methodological caveats are important. The Forbes list is an eyeball estimate at best as many billionaires may hide their wealth. Attributing rent-seeking entirely to a few industries is somewhat arbitrary: all sectors can potentially become rent-seeking or turned competitive. And high levels of profitability in the resource sector could also reflect entrepreneurial risk taking and a willingness to invest in difficult operating environments).

The Forbes 2014 list has 1,645 billionaires with a combined wealth of $6.5 trillion. Of these, 153 of obtained their billions from extractive sectors, accumulating $627 billion, or 10 percent, of the total. But for some countries, such as Kazakhstan, Russia and Ukraine, over 50 percent of billionaire wealth is linked directly to resource extraction.

Our illustrative list of 17 selected countries (the top 15 where resource cronies are most prominent plus the US and China) covers over 90 percent of the $627 billion in resource wealth held by billionaires. Our first observation is that resource billionaires are concentrated in a few countries; in fact, more than half of the resource billions are held by Russian and American billionaires. Oil and gas is much more prominent than mining on the list, indicating higher rents on hydrocarbons. Wealthy individuals who are citizens of resource-poor countries actually appear in the list: Israel, Portugal, Belgium, Greece and Switzerland are all in the top 25 list of countries with billionaire resource wealth. These “resource cronies” reside in jurisdictions that are almost certainly different to where their resource-based wealth originates. This scale of international financial flows—some stemming from rent-seeking in the world’s poorest countries—highlights the importance of international, as well as domestic actions to address good resource governance.

Source: Forbes, IMF, World Economic Forum, Economist, RWI-NRC