EITI Data Can Support Guinea’s Efforts to Promote Local Mining Subcontractors

Mining subcontractors are important taxpayers and drivers of economic development. But they have not received the same level of attention as mining companies do in terms of transparency, accountability or tax contributions. Guinea, however, has been a pioneer in including information about subcontractors in its Extractive Industries Transparency Initiative (EITI) reports. (Mali also does it.) This is a trend that we at NRGI expect to grow as governments, companies and citizens become more interested in understanding the role subcontractors play.

Guinea’s 2017 EITI report is more detailed than ever before, a marked step forward in reporting about subcontractors.

The number of subcontractors included in EITI reports has grown from 11 in 2014 to 19 in 2016, and is up to 36 with the latest report. By including subcontractor names, EITI reports increase the accountability of companies that are often unknown to the public. This can also help Guinean entrepreneurs identify business opportunities: subcontractors are also obliged to meet local content targets of the country’s mining code and will often “sub-subcontract” smaller works, easier for small and medium-sized enterprises to take on. They also complement government efforts like the Guinea subcontractor exchange, a multi-stakeholder platform aiming to connect local suppliers to mining companies, launched in December 2018. Elsewhere, companies such as Rio Tinto, with its Oyu Tolgoi mine in Mongolia, have also taken steps to disclose who their suppliers are.

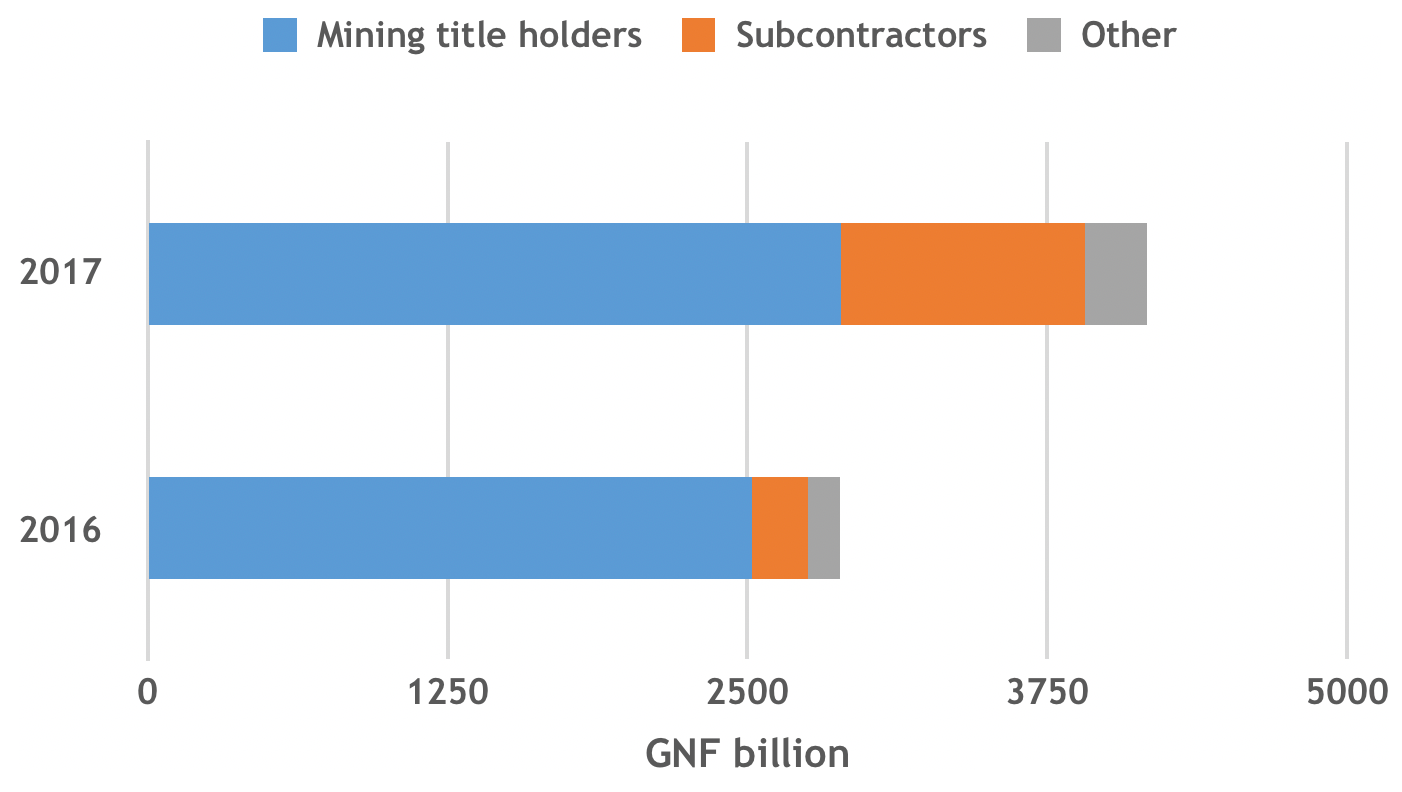

Revenues recorded from subcontractors operating in Guinea grew more than four-fold between 2016 and 2017, from GNF 234 billion (USD 25.3 million) to GNF 1,016 billion (USD 112.8 million). (See figure below.) The contribution of subcontractors to total extractive revenues covered in EITI reports grew from 8 percent in 2016 to 24 percent in 2017, reflecting the recent boom in the country’s mining sector. Indeed, typically, anywhere between 30 and 90 percent of mining project spending goes to subcontractors and suppliers.

Guinea government revenue contribution by company segment, 2016 and 2017

The 2017 report disaggregates subcontractor payments, adding new detail.

- Payments by company. The subcontractors covered in the 2016 EITI report contributed over 99 percent of total subcontractor revenues also in 2017, so the increase in overall subcontractor payments cannot be attributed to increased reporting coverage. In fact, in 2017, 82 percent of subcontractor revenues were paid by only two companies: Winning Alliance Ports (59 percent) and United Mining Supply (23 percent). They are also members of SMB Winning consortium—the leading bauxite producer in Guinea, whose production grew by 150 percent between 2016 and 2017. Other notable tax payers are large international drilling and engineering companies like AMCO Drilling and Fluor.

- Payments by receiving government entity. Fifty-eight percent of subcontractor payments were made to customs (Direction Générale des Douanes) and 42 percent to the tax authority (Direction Nationale des Impôts). Import duties and customs payments are more important in the subcontractor segment than for extractive revenues in total (37 percent of all payments covered in the EITI report went to customs). In this context, EITI reports since 2011 have been flagging discrepancies in customs reporting by subcontractors, who use customs forms reserved for mining title holders to benefit from import duty exemptions even though subcontractors can also be eligible for exemptions under certain conditions. Authorities and citizens can use public domain data to monitor exemptions granted to different types of companies and inform discussions on how incentives support different policy objectives. While exemptions can be a good for investment, they may contradict local procurement targets. In the Responsible Mineral Development Initiative (RMDI) workshops organized by the Ministry of Mines and Geology in May, Guinean entrepreneurs highlighted these inconsistencies as contributing factors to their poor competitiveness versus international subcontractors.

To date, this type of information is sparse in most mining countries, showing the value of Guinea’s effort. But EITI reporting can go further. Many countries already track progress on local content in EITI reports. Although subcontractors are not directly covered by the EITI Standard, requirement 6.1 mandates extractive industry companies to disclose material and in-kind social payments, including commitments to local employment and procurement. If ratified as expected in the next EITI board meeting later this month, the new standard will encourage countries to describe the rules and practices related to state-owned enterprises’ operating and capital expenditures, procurement, subcontracting and corporate governance. As countries are making progress toward the 2020 EITI timeline for beneficial ownership disclosure, some national EITI secretariats are starting to consider including subcontractors. Many subcontracting governance risks relate to complex ownership structures, such as cost inflation in subcontracting between related parties or conflicts of interest.

In summary, in Guinea and elsewhere, complementary reporting by government and country-level EITI multi-stakeholder groups can generate the following types of information for regulators, which prospective entrepreneurs and citizens can use to monitor progress and ensure accountability in the process of allocating subcontracts:

- Market size (opportunities for Guinean entrepreneurs, subcontractor tax base and actual payments)

- Actors (local and international subcontractors, and who actually owns them)

- Rules (rules applying to tender procedures, prequalification and selection of subcontractors)

- Processes (when are opportunities coming out)

- Outcomes (which entity awards contracts to whom, and are mines on track to meeting local content targets)

Kaisa Toroskainen is an Africa program officer with the Natural Resource Governance Institute (NRGI). Hervé Lado is NRGI’s Guinea country manager.