Oil, Gas, Mining Remain Major Focus for FCPA Investigations

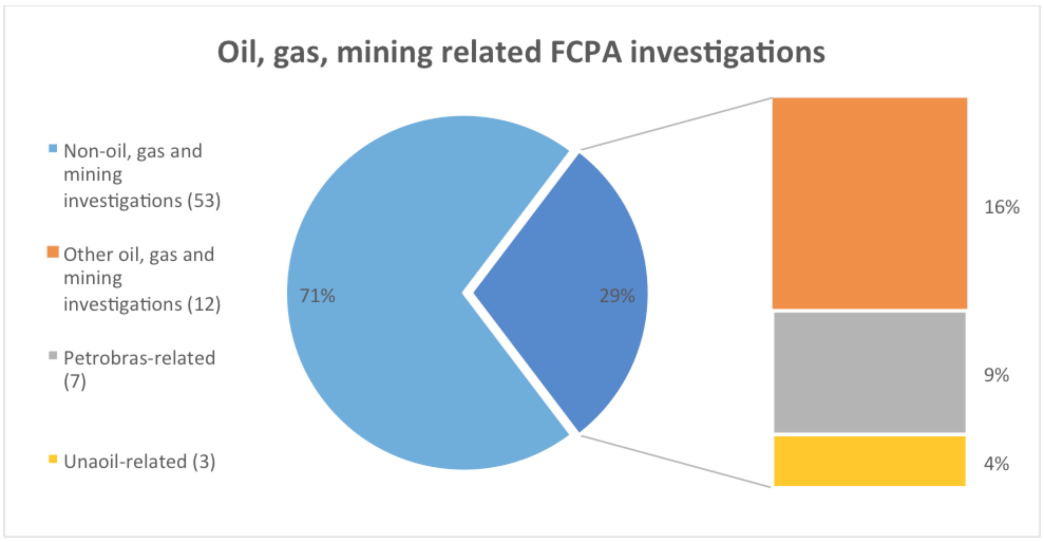

Last Tuesday, the FCPA Blog listed companies that are subject to ongoing and unresolved Foreign Corrupt Practices Act (FCPA)-related investigations. Nearly one-third are oil, gas or mining companies.

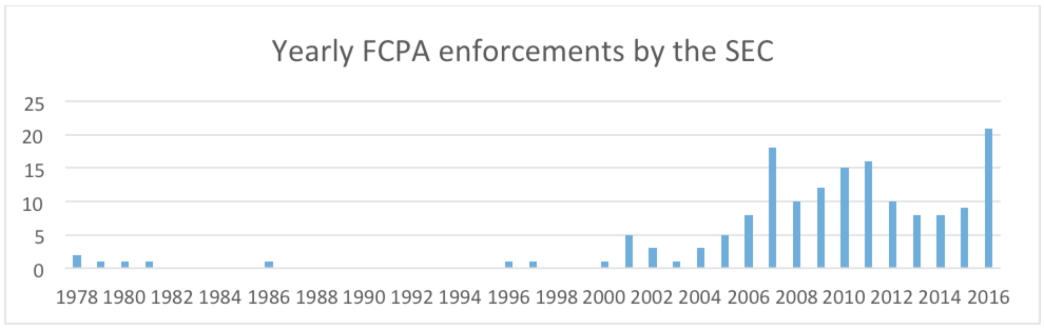

The FCPA is a U.S. federal law that criminalizes the bribery of foreign officials by companies based in the U.S. or listed on U.S. stock exchanges. Since its enactment in 1977, the number of companies prosecuted under the law has steadily grown due to shifting global norms and growing resources for enforcement. In 1978, there were two enforcement actions by the U.S. Securities and Exchange Commission (SEC); in 2006 there were eight, and since the start of this year there have already been 21.

Data taken from https://www.sec.gov/spotlight/fcpa/fcpa-cases.shtml (as of 5 October 2016)

A total of 75 companies currently face ongoing or unresolved FCPA investigations related to bribery of public officials outside of the U.S., according to the FCPA Blog list. These companies have not yet been formally charged by U.S. authorities, and it remains entirely unknown whether they engaged in any illegal behavior—but their actions have caused enough suspicion for the SEC to investigate.

I found that 22 of the 75 investigations, or 29 percent, relate to the extractive sector. This is a stark reminder that despite low commodity prices, the large rents up for grabs in the oil, gas and mining sector can create strong incentives for potentially corrupt behavior.

A closer look at the list reveals some interesting things about today’s corruption landscape. A large share of the investigations relate to the fallout from the Petróleo Brasileiro S.A. (Petrobras) scandal. With shares listed on the New York Stock Exchange, Petrobras came under scrutiny from the SEC following investigations in Brazil into its corrupt procurement practices. These investigations in turn led the SEC to probe at least seven additional companies.

The leaked Unaoil S.A.M documents revealed how dozens of leading companies hired the same “fixer” company to reach government officials in a number of resource-rich developing countries. The leaks have prompted the SEC to examine potential FCPA breaches by at least three companies: KBR Inc., FMC Technologies Inc. and Core Laboratories NV. These examples demonstrate that when law enforcement gains access to insider company information, such as through leaks or investigations, it prompts the investigation of additional deals or players – a sort of anti-corruption domino effect.

| Entities facing FCPA investigations related to the Petrobras scandal | Entities facing FCPA investigations related to the Unaoil leaks |

|---|---|

| Vantage Drilling Company | KBR Inc. |

| Transocean Ltd | FMC Technologies Inc. |

| SBM Offshore NV | Core Laboratories NV |

| Ensco PLC | |

| Centrais Elétricas Brasileiras SA | |

| Sevan Marine ASA | |

| Braskem SA |

Of the 22 extractives-related companies under investigation, three are mining companies: Kinross Gold Corporation, Newmont Mining Corporation, Sociedad Química y Minera de Chile S.A (SQM). But the majority (16 of 22) operate in the oil and gas sector; of these, most are oilfield service companies that provide goods and services such as drilling platforms or pipelines. The prevalence of service companies in current and past FCPA investigations suggests that subcontracting is an area that requires particular attention in anti-corruption efforts. Despite this record of FCPA investigations, subcontracting has not featured prominently in initiatives such as the Publish What You Pay campaign or the Extractive Industries Transparency Initiative.

There are also a few interesting outliers: companies whose core business is not the oil or mining industry, such as the engineering company Sevan Marine ASA, which may have been involved in the Petrobras scandal. We also include the investigation into banking giant Goldman Sachs. The SEC investigation into Goldman stems from the wider suspicions around the operations of a Malaysian government investment fund called 1MDB. Much of the money that flowed into the 1MDB fund, including some via deals orchestrated by Goldman, came from oil boom revenues in the United Arab Emirates. It is important to conceive of extractive sector corruption widely, including possible efforts to capture rents through investment activities, as well as the more typical bribery problems in upstream operations.

While we can’t know whether the companies being investigated will be prosecuted, many have been in the past. Oil service company KBR Inc. (currently under investigation in connection with the Unaoil scandal) agreed in 2009 to pay a fine of USD 402 million after pleading guilty to bribing Nigerian officials for access to lucrative contracts to build liquefied natural gas facilities. Italy’s Eni S.p.A was implicated in the same bribery scheme and negotiated a settlement of USD 365 million, and has faced FCPA investigations in its Libya and Algeria business as well. These experiences demonstrate the significant financial costs companies (and their investors) can face for violating the FCPA; but they also suggest that such fines may not deter suspicious behavior in the future.

The prevalence of oil, gas and mining companies facing FCPA investigations today suggests that extractive sector corruption is alive and well, and requires redoubled efforts at its prevention. At NRGI we are using information made public as a result of dozens of FCPA court cases in order to better understand the mechanics of corruption in the oil, gas and mining sector, and produce new analysis and tools for anti-corruption actors.

To generate its list, the FCPA Blog drew only on “disclosures in SEC filings or on other self disclosures by non-issuers,” rather than media reports.

My assessment of whether an investigation of a company is associated with either the Petrobras scandal or the leaked Unaoil documents is based either on SEC filings or media reports. For more information on these associations, please follow the hyperlinked company names in the table above.

Max George-Wagner is a governance associate with NRGI.