What the Pandemic Reveals About Governance, State Capture and Natural Resources

This post was first published by the Brookings Institution.

The COVID-19 pandemic has laid bare the contrasting strengths and weaknesses in governance and leadership across the globe. Among high-income countries, many European states that have excelled in various governance dimensions, as measured by the annual Worldwide Governance Indicators (WGI), have also addressed the pandemic well. These include the women-led Germany and the Nordic countries (except for Sweden). By contrast, the pandemic is raging in much of the United States, with well over 130,000 deaths and 3 million reported cases (accounting for one-quarter worldwide, with only 4 percent of the world’s population).

Poor management of the pandemic in the U.S. correlates with the country’s declining governance over the years compared with many European countries—as well as with Japan and others in Asia. WGI data show that by 2018 the U.S. ranked only 29th in the world in “voice and accountability” measures, and 25th in control of corruption, following a decline over the past two decades. Worsening governance performance has been compounded over the past few months by a very poor leadership response to the pandemic. The high variance in governance performance across countries also applies globally, including among low- and middle-income countries. Among other emerging regions, Latin America has been generally struggling, with the virus out of control in Brazil and Mexico, among others, yet by contrast well governed countries like Uruguay and Costa Rica have been coping well.

Many countries, across all regions, including the majority of those rich in natural resources, exhibit weak—and often worsening—governance standards, including leadership failures; a retreat in “voice” and democratic accountability; and, related, high levels of corruption and capture by political and economic elites. Yet governance matters more than ever right now: Countries with better governance standards are exhibiting a better response and results in coping with the pandemic than poorly governed countries, as suggested by the association between COVID-19 testing ability and infection rates in Figures 1a and 1b, respectively, and various governance dimensions.

Source: Worldometers, https://www.worldometers.info/coronavirus and Worldwide Governance Indicators (www.govindicators.org). Kaufmann, D., A. Kraay, & M. Mastruzzi (2010), The Worldwide Governance Indicators: Methodology and Analytical Issues, World Bank Policy Research Working Paper No. 5430.

The pandemic-induced socio-economic shock is afflicting countries all around the globe. It is unlikely to be temporary, with scores of millions falling back into poverty, a shrinking middle class, and growing social tensions. Depending on the extent to which vested economic interests influence policymaking, countries are differently navigating a perceived “tradeoff” between opting for health-induced lockdowns (and strict distancing with gradual re-openings), on the one side, or economics-driven rapid reopening and macro-economic rescue packages. But this is a false tradeoff, due to the havoc the virus is wreaking in states that didn’t implement strict distancing measures and/or rushed to re-open, forcing closure reversals and compounding the economic setback.

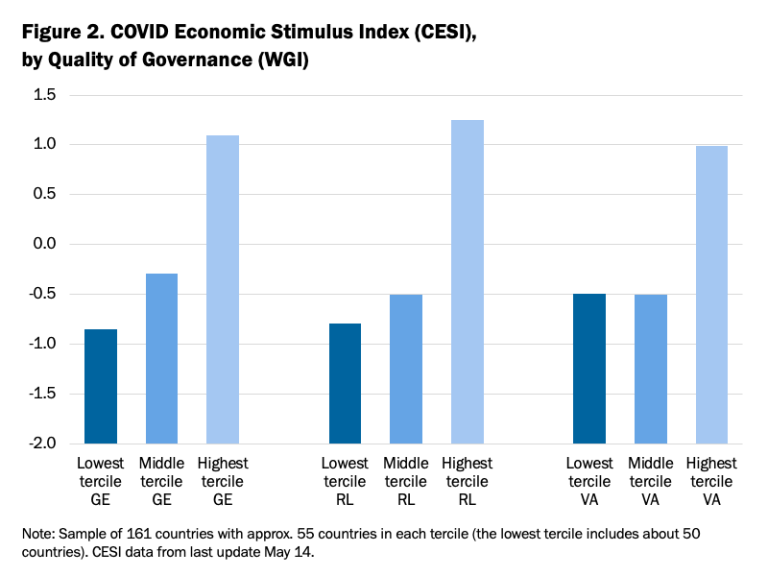

Countries are also contending with the need to implement fairly allocated and generous stimulus and rescue packages, while remaining prudent about debt and fiscal sustainability in the longer term. Again, governance matters. The COVID-19 Economic Stimulus Index (CESI) shows an association between countries exhibiting better governance in key dimensions and better performance of their economic stimulus programs:

Source: Worldometers, https://www.worldometers.info/coronavirus and Worldwide Governance Indicators (www.govindicators.org). Kaufmann, D., A. Kraay, & M. Mastruzzi (2010), The Worldwide Governance Indicators: Methodology and Analytical Issues, World Bank Policy Research Working Paper No. 5430.

One group of low- and middle-income countries are experiencing particularly acute challenges—those that are resource rich. With some exceptions, their governance woes are dire, as discussed in the past, and presented in detail in a new report on addressing corruption in natural resources.

Already weak health systems in resource-rich countries are struggling to cope. Only one-half of a percent of the population of these countries have been tested so far, ineffective for any containment. As depicted in Figures 3a and 3b respectively, recently both their infection and death rates have been increasing sharply, in contrast with other emerging economies (and also high-income countries, wherewith the exception of the U.S. rates have been falling sharply).

Source: Worldometers, www.worldometers.info/coronavirus

Another shock, particularly for resource-rich countries, relates to the drop in demand for and prices of hydrocarbons and minerals, against the backdrop of the imperative to address climate change and environmental damage. The reality of lower demand for fossil fuels associated with lockdown restrictions is placing downward pressure on prices. The likely growth in appetite for cleaner energy (including due to expected post-pandemic demand for a healthier planet), and, on the supply side, the ease of entry in the shale oil and gas industry, complemented by ample reserves and inventories, will together cap future oil and gas prices. Supply chain disruptions and poor governance also hamper production and delivery.

In short, a confluence of a quartet of factors and shocks points to a perfect storm: particularly for resource-rich countries and the extractives sector, the pandemic itself; daunting governance, capture, and leadership challenges; socio-economic crisis; and the fall in prices of extractives. A strategic rethink is warranted. Here I suggest some initial pointers for further debate and elaboration:

- Reframing corruption and governance: the state capture lens. The governance of institutions and leadership in many countries has been compromised by the vested interests of the political and economic elite. n its purest form, we have called this state capture, referring to the narrow yet powerful elite vested economic and political interests who shape the “rules of the game” for their own benefit, at the expense of the public good. It is timely to traverse more systematically beyond traditional notions of corruption, which have typically focused on administrative corruption such as bribery, toward higher-level forms of political and economic misgovernance, such as state capture. Within the latter, of highest priority is identifying and rigorously codifying the main sources of capture, as well as the incentives and political economy drivers of capture in shaping of the laws, regulations, and policies of the state. Reformers must also address legal forms of corruption and misgovernance. In the pandemic context, policy analysts and activists could use such a lens to diagnose and counter inaction or self-serving public health responses and economic stimuli, as well as identifying and addressing obstacles to the required economic diversification and restructuring of the extractive industries. Further, diagnostic and action planning tools would also benefit from using the state capture lens to offer pointers to diagnose and help counter the attack on citizen “voice” and democratic institutions in many countries.

- Radical transparency. Vested economic and political interests are exploiting the pandemic to their benefit, including by some oil companies as well as billionaire-backed businesses and associates of the U.S. President having access to funds aimed at helping small firms in distress. This pernicious development threatens hard-won transparency gains attained over the past decade. Further, extractive companies in the U.S. and elsewhere are making the case for relaxing disclosures of their payments to governments, misleadingly arguing that they are onerous, when in fact transparency reforms tend to be low-cost and result in net overall savings (as I argued to the SEC). Rather than taking a defensive stance to partially protect existing disclosure requirements, international initiatives and NGOs should adopt a more radical and proactive approach. This is in part because much still lies ahead in terms of implementing effective transparency (responding to a need for more timely, granular and comprehensive data), and also because a more radical transparency—in industry and government—is needed to expose and address state capture. A more ambitious radical transparency drive would mean that decisive progress would be warranted in mechanisms such as the Extractives Industry Transparency Initiative (EITI), mandating pending disclosures regarding industry bailouts, subsidies, tax breaks, and industry cost structures, as well as on contracts, commodity trades, and climate and environmental impacts. Complementing these, think tanks and specialized NGOs should invest in frontier, evidence-based diagnostics and data tools that authorities and other stakeholders would use, in alignment with the current physically distanced pandemic circumstances.

- Health focus. A deliberate strategic pivot in governance, transparency and accountability in natural resources would also include supporting an enhanced response to the pandemic, given the evidence pointing to the links with governance. For a start, officials could leverage transparency and accountability to move toward more effective and equitable (and thus non-captured) economic policies and packages that strengthen the health sector and the pandemic response. Further, specific natural resource governance institutional initiatives could contribute to addressing the health challenge, e.g., via judicious utilization and improved governance of sovereign wealth funds. In diversifying away from oil dependency, further focus is needed on services, and within them, public health. And then there is the major imperative for the IMF, the World Bank, and other lenders and donors to link international aid and financial assistance to pending governance and transparency reforms by recipient countries. Providing funds where opacity and corruption still reign will again risk major leakages as well as the elite capturing funds, and will fail to strengthen responses to the pandemic and to economic contraction.

- Industry revamp and the energy transition. Over the years, incentives for the growth of renewable energy and for initiatives towards economic diversification have garnered significant interest. Yet arguably a very simple move in the direction of diversification and energy transition would be to focus squarely on the fossil fuel sector itself: start by “leveling the playing field.” The industry’s myriad implicit and explicit subsidies and tax breaks; bailouts; often opaque, captured and corrupt deals not made in the public interests pose major obstacles to the energy transition. And powerful vested interests in the sector, emanating from some governments and companies (both private and state-owned) conspire against the required restructuring of the sector and the reduction of resource dependency generally, and slow the energy transition. In particular, high-cost and new oil producer countries should adopt strategies aligned with a transition to diversified economies and a low carbon world. Likewise, the perfect storm afflicting resource-rich countries has far-reaching implications for the already generally weak state companies in extractives; plodding, incremental reform attempts will no longer be tenable. To avoid being left stranded and a continuing economic (including debt) and governance drag, public enterprises must undergo a radical transformation, becoming modern and well-governed energy companies attuned to the new economic and energy realities. In some cases, the only viable option may be to start from scratch. In fact, a major transformation of public and private industry needs to envisage a rather different company of the future in many settings—transparent, well governed, embracing frontier AI tools, sustainable, and focused on clean energy.

Against the backdrop of the ongoing tempest in resource-rich countries, this time it truly is different. Reactive approaches merely focused on adaptations to a traditional downturn or to mere volatility would be ill-advised. It is imperative that governments, industry, international organizations, NGOs, and think tanks consider and implement bold transformations commensurate with the extent of the challenge in a changed world.

Daniel Kaufmann is chief advisor and president emeritus of the Natural Resource Governance Institute (NRGI).

Authors

Daniel Kaufmann

President Emeritus