Debt Sustainability Challenges in Resource-Rich Developing Countries

A 10-year boom in the prices of many commodities drew to a close last year. During previous booms, governments in developing countries have often squandered wealth accumulated through oil, gas and minerals, directing little of the proceeds toward effective investment or saving. When boom turned to bust, resource-rich countries were caught out, forced into debt spirals.

At the beginning of this decade, observers had reason to be more optimistic about how windfall revenues were being managed—many countries had put commitments and rules in place to prioritize productive domestic investment or saving for “rainy days.” With commodity prices now low again, these policies have been put to test and fiscal sustainability is once again a burning question.

The International Monetary Fund (IMF) and the World Bank are currently undertaking a review of their debt sustainability framework for low-income countries. They use the framework to assess countries’ risk of debt distress; the results are closely watched by financial markets and aid donors. Framework assessments can therefore impact how much additional borrowing countries can access, and at what rates. We at the Natural Resource Governance Institute (NRGI) submitted comments to the fund and bank on how the framework could better address the particular debt sustainability challenges faced by resource-rich countries.

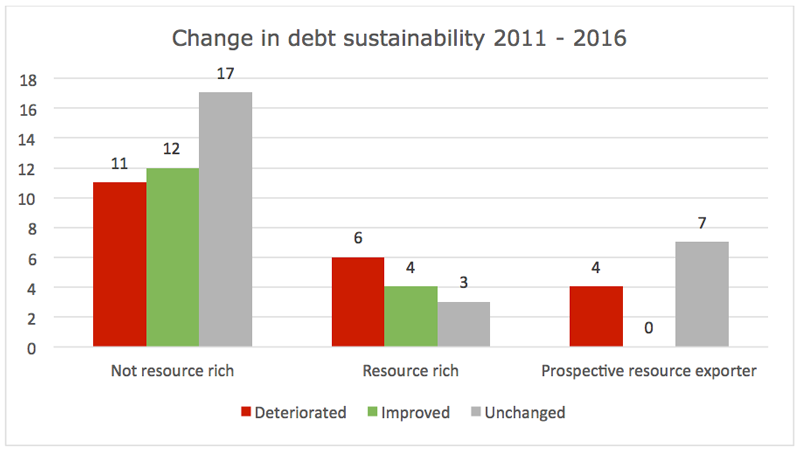

To place the importance of these challenges in context, I analyzed how shifts in the World Bank/IMF debt sustainability assessments (DSA) varied depending on countries’ levels of dependence on natural resources between 2001 and 2016. Of the 70 low-income countries where the bank and IMF conducted debt sustainability analysis, 13 were classified as resource-rich and an additional 11 as prospective natural resource exporters in 2012. The following graph shows the results of the latest assessment available for each country in three years when summary results were published (2011, 2013, 2016).

Click to enlarge.

DSA results from 2016 are available from the IMF website. I obtained results from 2011 and 2013 using the Wayback Machine internet archive, where original IMF PDFs are stored even after removal from the IMF website. I then scraped the files, compiled the data into a dataset, and visualized it using Tableau.

At the beginning of this decade, the majority of resource-rich and prospective exporter countries had low debt burdens as a result of the HIPC debt relief initiative and a favorable economic outlook due to rising commodity prices. This picture is confirmed by the 2011 cross-country review of debt sustainability analysis, reporting that only 25 percent of these countries were in debt distress or at high risk of debt distress, compared to 35 percent across all other countries assessed. The picture remained largely unchanged when it was rendered in 2013. But following the recent decline in commodity prices the analysis has changed significantly. According to the latest list of debt sustainability analysis published in this year, the IMF considers 33 percent of resource-rich and prospective resource exporter countries in debt distress or at high risk of debt distress, compared to 28 percent across resource-poor countries.

The data allows us to track changes for each country over time across the different assessments. For the period for which data was available using the 2011 and 2016 list of assessments, the risk of debt distress on average decreased across resource-poor countries, while it increased somewhat in resource-rich countries, and even more so in countries classed as prospective resource exporters.

Some of the most dramatic examples include Ghana and Mozambique, where hopes of imminent resource riches might have contributed to ballooning borrowing. In Mozambique, after major gas discoveries in 2010, negotiations with investors dragged on for years. (A final investment decision is expected by the end of the year.) During this same period the government accumulated enormous debt—some of it secretly for purchasing military hardware. In Ghana, despite rapid progress moving from the first major oil discovery in 2007 to production in 2010, government revenue accumulation remained low—far below what would have been required to keep up with the rapid increase in government spending. The government of Mozambique recently requested assistance from the IMF, while Ghana obtained an IMF bailout last year.

In other places, the debt sustainability outlook reported by the IMF remained unchanged, but extractive projects such as the Simandou project in Guinea and the Tonkolili project in Sierra Leone are major nodes of uncertainty. Both iron ore mines were projected to double their countries’ GDP only a few years ago, but their future is now uncertain after delays, halts and changes in ownership. Studies of the history of resource-rich countries also show that the effects of commodity price volatility are a key contributor to the “resource curse.”

After the number-crunching and country cases, it’s clear that the debt sustainability framework should pay special attention to both resource-rich developing countries and prospective exporters of resources. In our comments to the IMF we provide recommendations on how the framework could incorporate the special characteristics of these countries more directly and transparently:

- Analyze scenarios related to delays or cancellation of giant extractive projects

- Ensure that non-traditional debt instruments tied to commodities are adequately captured in the framework

- Provide special attention to the sustainability risks caused by the opacity of the resource sector

The note also provides suggestions on making the framework more accessible for reuse, which would make it much easier for civil society organizations, researchers and the private sector to reproduce and scrutinize analysis (like that above) and conduct more detailed reviews of sustainability.

David Mihalyi is an economic analyst with NRGI.