Glencore Discloses Payments, But Omits Trading Activities

To comply with new U.K. reporting regulations, global commodities giant Glencore published a report today that summarizes the payments it made to governments in 2015. The figures shed light on the company’s extensive exploration and production activities. Glencore’s even larger trading business, however, remains in the dark.

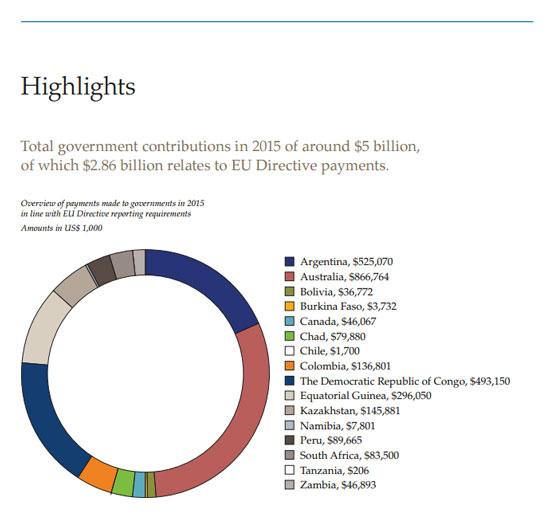

Glencore joins a growing number of London-listed companies that have published payment data this year. Glencore provides this information for each individual oil or mining project across 16 countries. Its extractive-specific payments totaled USD 2.8 billion, with Australia (USD 867 million), Argentina (USD 525 million) and the Democratic Republic of the Congo (USD 493 million) topping the list of recipients. Glencore also elected to disclose additional, non-sector-specific taxes, as have a few other companies, presumably to demonstrate its overall contribution to host country governments.

Source: Glencore Payments to Governments Report 2015

The report is, however, noticeably silent on trading activities. While Glencore has increased its exploration and production activities in recent years, including through its merger with Xstrata, it remains one of the world’s largest commodity traders. Glencore buys billions in raw materials from governments around the world, including those of developing countries. These payments remain opaque.

For example, today’s report reveals that Glencore made payments totaling USD 80 million to the government of Chad. While sizable for Chad—one of the world’s poorest nations—these payments are tiny compared with the USD 1.5 billion oil-backed loan that Glencore provided to the Chadian government in 2014. The repayment of the loan likely began in 2015, though it might have been impacted by the rescheduling negotiated by the parties following the drop in oil prices.

Glencore’s report contains no information on this enormous loan. Nor does it cover any payments that Glencore made to Chad in exchange for crude oil. We estimated that Glencore paid the government of Chad around USD 400 million for crude oil in 2013, an amount equal to 16 percent of total government revenues that year. While 2015 sales were likely worth less due to lower oil prices, the economic importance of these trading deals to Chad is clear; the information surrounding the deals is not.

Glencore is not alone in deciding not to disclose trading payment data. Shell, BP and Total have all released payment reports in the past couple months in compliance with the U.K. regulations. None of those reports cover trading payments, even though each of these companies manage huge oil trading businesses and numerous trading deals with governments.

Addressing this reporting gap requires a three-pronged approach, which we outline further in this briefing:

- Home country transparency regulations, such as those in the U.K., should explicitly include trading payments.

- Companies like Glencore should voluntarily disclose these payments in their next report. (Trafigura made a nice start in this regard in 2014.)

- Producing country governments should report on the sales, including through the Extractive Industries Transparency Initiative.

For citizens of Chad and other resource-rich countries, action on these fronts will deliver transparency on the full range of payments that require greater oversight.

Alexandra Gillies is the director of governance programs at the Natural Resource Governance Institute (NRGI).